|

|

|

|

|

IP Newsletter | Winter 2013/14

|

|

|

|

|

|

|

PATENT |

|

|

|

KIPO’s Growing Popularity as an ISA for U.S.-Originating PCT Applications |

|

|

|

Under the PCT system, each application must undergo an international patentability search by a designated international search agency (“ISA”). As of the beginning of 2013, there were 15 national (or regional) patent offices or organizations operating as ISAs around the world, at least one of which must be made available for selection through the receiving office where the PCT application is filed. With the continuing growth in the number of international patent filings, and companies’ growing need to pursue IP protection in multiple countries, the choice of ISA to perform the search on a given application is becoming increasingly important. |

|

|

|

In 2012, the Korean Intellectual Property Office (“KIPO”) was the third-most selected ISA for PCT applications, issuing 14.1% of all International Search Reports (ISRs) issued that year (trailing only the European Patent Office (“EPO”) (with 38.5% of issued ISRs) and the Japan Patent Office (“JPO”) (with 21.5% of issued ISRs)). The statistics show that there has been a continuous increase in the number of ISRs issued by KIPO in the last several years. In the first quarter of 2013, KIPO has issued 12,837 ISRs, a nearly 62% increase from the same period in 2012, in which it issued 7,925. |

|

|

|

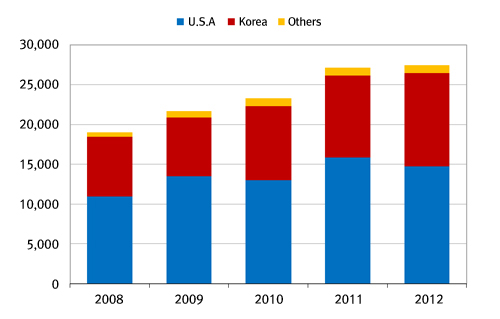

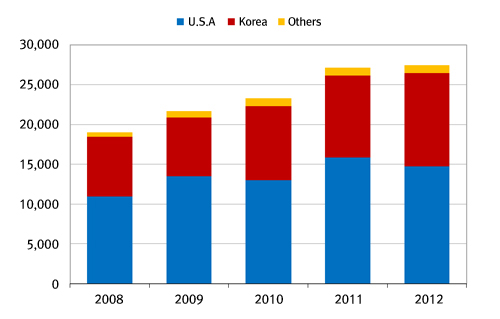

Notably, more than half of all ISRs issued by KIPO in the past five years were for PCT applications that originated from the U.S.A., even outnumbering ISRs for Korea-originated PCT applications. |

|

|

|

Number of ISRs issued by KIPO for the past five years |

|

|

|

|

|

| Year |

2008 |

2009 |

2010 |

2011 |

2012 |

| Total |

19,020 |

21,715 |

23,303 |

27,139 |

27,442 |

| Origins |

U.S.A. |

10,904 |

13,453 |

12,995 |

15,906 |

14,685 |

| Korea |

7,553 |

7,434 |

9,342 |

10,225 |

11,781 |

| Others |

563 |

828 |

966 |

1,008 |

976 |

Source: WIPO statistics database

|

|

|

|

With respect to which individual companies have most utilized KIPO as an ISA in recent years, while comprehensive statistics are not available, a review of various publicly available sources indicates that the top corporate users of KIPO for ISA services are Intel, HP, Microsoft, Baker Hughes, Applied Materials, and 3M. |

|

|

|

KIPO’s Strong Appeal as an ISA Choice for U.S.-Originated PCT Applications |

|

|

|

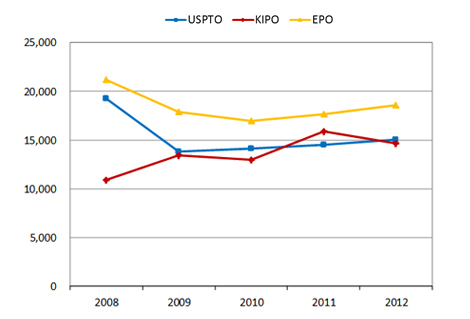

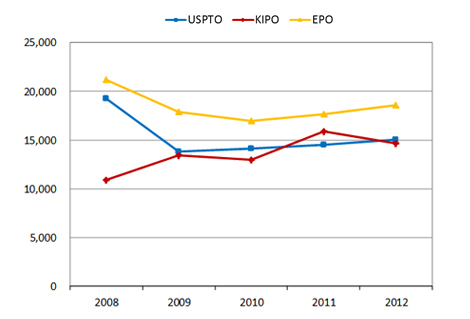

With respect to the number of ISRs prepared by ISAs specifically for PCT applications originating from the U.S., KIPO has performed very well relative to other ISAs. While the EPO has consistently topped the list as the most-selected ISA for such applications over the last five years, KIPO has not been far behind, and has been selected almost as often as the United States Patent and Trademark Office (“USPTO”) for U.S.-origin PCT applications in that timeframe. In fact, KIPO surpassed the USPTO in terms of ISR output for U.S.-origin PCT applications in 2011. |

|

|

|

KIPO does face growing competition from other lower cost ISAs for U.S.-related PCT search services. In particular, Russia’s and China’s patent offices have shown significant growth in the issuance of ISRs for U.S.-originated PCT applications in 2012, and the data for Q1 of 2013 (the most recent available) shows that this growth trend is continuing. |

|

|

|

Number of ISRs issued by USPTO, KIPO and EPO for PCT applications originating from U.S.A. |

|

|

|

|

|

|

| Year |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 Q1 |

| EPO |

21,153 |

17,881 |

16,963 |

17,634 |

18,562 |

4,990 |

| USPTO |

19,291 |

13,835 |

14,142 |

14,476 |

15,018 |

3,988 |

| KIPO |

10,904 |

13,453 |

12,995 |

15,906 |

14,685 |

3,942 |

| Rospatent (Russia) |

14 |

21 |

4 |

22 |

1,355 |

574 |

| SIPO (China) |

115 |

138 |

295 |

496 |

899 |

280 |

Source: WIPO statistics database |

|

|

|

Advantages for U.S. Companies of Using KIPO as ISA |

|

|

|

When polled, U.S. companies generally cited three factors for choosing KIPO as an ISA - (i) the relatively good quality of their ISRs, (ii) significantly lower costs, and (iii) relatively timely issuance of ISRs. The third factor has presented some challenges in recent years, as discussed in more detail below. |

|

|

|

1. Quality |

|

|

|

U.S. companies appear to perceive KIPO as offering good value as an ISA, providing satisfactory search results at a reasonable cost. For example, a recent report by inovia, a well-known foreign patent filing provider, indicates that surveyed entities have “[g]enerally positive feelings” about their experiences with KIPO (“The 2013 Global Patent & IP Trends Indicator”, inovia, page 8). Further, according to an initial report on quality management systems prepared by KIPO in 2012, all of the PCT examiners at KIPO are required to have expertise in natural sciences and engineering, as well as the necessary language skills to comprehend foreign PCT documents and to prepare ISRs and IPERs in English. KIPO also provides both Japanese-Korean and English-Korean machine translations of foreign patent documents, and KIPO's Patent Search system (KOMPASS) enables patent examiners to conduct full text searches of patent documents from Korea, Japan, China, the U.S., and Europe. KIPO also has access to a wide base of prior art, due to Korean companies’ long history of activity in many industries (e.g., semiconductors, telecommunications, and home appliances), tending to further increase the quality of KIPO’s search results. |

|

|

|

2. Cost |

|

|

|

Among the three most-used ISAs for U.S. PCT applications (EPO, USPTO, and KIPO), KIPO’s search fee is generally the lowest, as shown in the table below. However, SIPO (China) and Rospatent (Russia) each charge significantly less than KIPO, which on the surface would suggest that they may have an advantage going forward in attracting U.S. and other foreign applicants to select those offices as ISAs. |

|

|

|

Unit: USD (as of Jan. 1, 2013 |

|

|

| EPO |

USPTO |

KIPO |

Rospatent |

SIPO |

| 2,545 |

2,080* |

1,212 (in English) |

209 |

343 |

* for small entity: 1,040; for micro entity: 520

|

|

|

|

A proper cost-benefit analysis for the prospective applicant also must consider that when filing in multiple countries, search or examination fees upon entry into the national phase are often reduced or waived if the ISR has been prepared by specific authorities. The following table compiles the relevant information for the EPO, USPTO, KIPO, SIPO and Rospatent: |

|

|

|

| ISA |

Fees at the national phase |

Waivers/exemptions |

| EPO |

1,165 Euro [Search Fee] |

| (i) |

Full exemption of search fee if EPO has prepared ISR |

| (ii) |

reduced by 190 Euro if APO (Australia), KIPO, SIPO, JPO (Japan), or USPTO has prepared ISR |

|

| USPTO |

USD 600* [Search Fee] |

| (i) |

reduced to USD 120* if USPTO has prepared ISR |

| (ii) |

reduced to USD 480* if any other ISA has prepared ISR |

|

| KIPO |

KRW 130,000 plus KRW 40,000 for each claim [Examination Fee] |

| (i) |

reduced by 30% if KIPO has prepared ISR |

| (ii) |

reduced by 10% if EPO has prepared ISR |

|

| Rospatent |

RUB 2,450 (for one invention)

RUB 1,950 (for each invention in excess of one) [Examination fee] |

| (i) |

reduced by 50% if Rospatent has prepared ISR |

| (ii) |

reduced by 20% if any other ISA has prepared ISR |

|

| SIPO |

CNY 2,500 [Examination Fee] |

| (i) |

Full exemption of the examination fee if ISR and the international preliminary report on patentability have been issued by SIPO |

| (ii) |

reduced by 20% if JPO, SPRO (Sweden) or EPO has prepared ISR |

|

* small entity: half of the indicated amount; micro entity: a quarter of the indicated amount |

|

|

|

(Compiled from the “PCT Applicant’s Guide – National Phase – National Chapter” annex for each country, available at http://www.wipo.int/pct/en/appguide/, December 10, 2013.) |

|

|

|

Assuming a scenario where an applicant (not a small/micro entity) intends to file a PCT application with 25 claims (directed to one invention) without requesting international preliminary examination and to designate all the countries of the above authorities for national phase entry, the total search cost due to selecting each of the above offices as the ISA can be summarized as follows: |

|

|

|

Currency rates as of Dec. 10, 2013 |

|

|

| Selected ISA |

ISR Fees |

Waivers/exemptions at the national stage |

Net Costs

(ISR Fees – Waivers/exemptions) |

| EPO |

USD 2,545 |

EPO

USPTO

KIPO

Rospatent

SIPO |

full exemption of USD 1,602

USD 120 reduced

USD 107 reduced

USD 15 reduced

USD 82 reduced |

USD 619 |

| USPTO |

USD 2,080 |

EPO

USPTO

KIPO

Rospatent

SIPO |

USD 261 reduced

USD 480 reduced

No benefit

USD 15 reduced

No benefit |

USD 1,324 |

| KIPO |

USD 1,212 |

EPO

USPTO

KIPO

Rospatent

SIPO |

USD 261 reduced

USD 120 reduced

USD 323 reduced

USD 15 reduced

No benefit |

USD 493 |

|

Rospatent |

USD 209 |

EPO

USPTO

KIPO

Rospatent

SIPO |

No benefit

USD 120 reduced

No benefit

USD 37 reduced

No benefit |

USD 52 |

| SIPO |

USD 343 |

EPO

USPTO

KIPO

Rospatent

SIPO |

USD 261 reduced

USD 120 reduced

No benefit

USD 15 reduced

No benefit |

USD -53 |

|

|

|

|

(NOTE: As noted above, this table does not account for the additional discounts or exemptions that may be available by selecting certain ISAs to perform the international preliminary examination as well, which may change the cost-benefit analysis in some scenarios.) |

|

|

|

This table helps explain why U.S.-originated PCT applications often select foreign ISAs such as EPO and KIPO rather than USPTO to issue ISRs, particularly if such applications are designated for entry into the national stage before the EPO and/or KIPO. As shown above, for applications that are designated for entry into Europe, the search costs for selecting the EPO as the ISA are comparable to those for KIPO and significantly lower than the USPTO once the national stage search costs are taken into account. |

|

|

|

Timeliness and Addressing Challenges for KIPO as ISA |

|

|

|

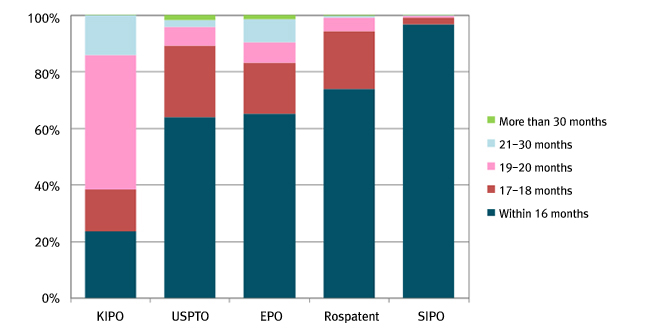

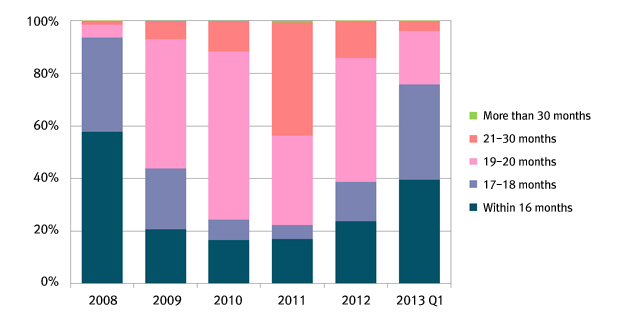

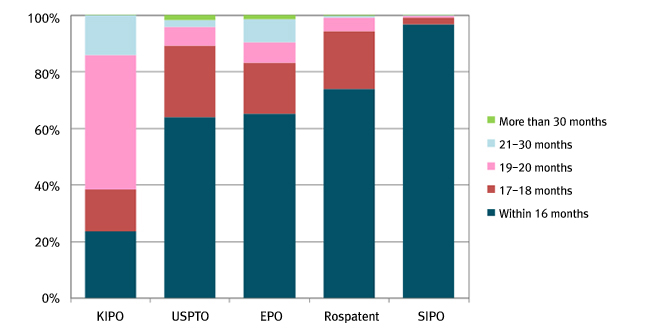

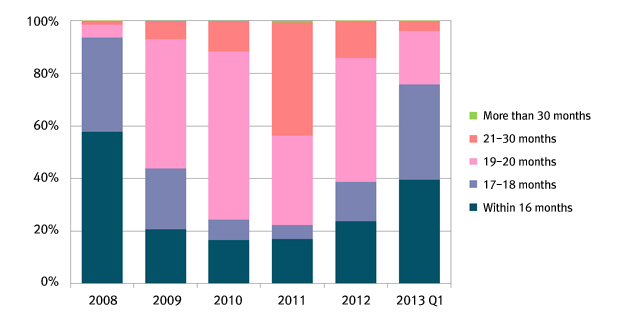

Although timeliness has been cited as a factor by companies for their choice of KIPO as an ISA, in recent years, KIPO’s efficiency has suffered as its popularity as an ISA has increased. As recently as 2006, 88% of ISRs issued by KIPO were delivered within 16 months of the application priority date, but compared against other ISAs, KIPO struggled to deliver timely ISRs in 2012. |

|

|

|

Timeliness of ISAs in Transmitting ISRs to the International Bureau in 2012 |

|

|

|

|

|

| Year |

KIPO |

USPTO |

EPO |

Rospatent |

SIPO |

| Within 16 months |

23.70% |

64.00% |

65.30% |

73.90% |

96.90% |

| 17-18 months |

14.80% |

25.20% |

18.00% |

20.70% |

2.40% |

| 19-20 months |

47.20% |

6.70% |

7.20% |

4.60% |

0.60% |

| 21-30 months |

14.10% |

2.50% |

8.20% |

0.80% |

0.10% |

| More than 30 months |

0.001% |

1.60% |

1.30% |

0.05% |

0.01% |

| Total |

29,907 |

16,336 |

72,232 |

1,918 |

18,221 |

Source: WIPO statistics database |

|

|

|

However, KIPO has recently made substantial efforts to reduce the gap with other competing authorities, which appear to be working. From a 2011 low of issuing fewer than 20% of its ISRs within 16 months, KIPO has recently made significant strides, with the most recent data from Q1 of 2013 indicating that the 16-month issuance rate is up to nearly 40%. |

|

|

|

|

|

Further, KIPO’s search cost, though still relatively competitive with other popular ISAs such as the EPO and the USPTO, is now being significantly undercut by SIPO and Rospatent, who will likely continue to gain in popularity as designated ISAs in part for this reason (although at present SIPO is not an option as an ISA for PCT applications where the USPTO is the receiving office). On the other hand, Rospatent in particular remains relatively untested in terms of the quality of their search results, capacity, and efficiency as an ISA. While KIPO will certainly need to continue to improve its timeliness as well as perhaps reconsider its fee schedule to remain competitive as an ISA of choice for U.S.-originated PCT applications, its advantages in terms of search quality and value-for-cost will likely continue to be significant factors for companies selecting an ISA. |

|

|

|

Back to Main Page |

|

|

|

|

|

If you have any questions regarding this article, please contact: |

|

|

|

|

|

|

|

For more information, please visit our website: www.ip.kimchang.com |

|

|